- programme@alma.ac.zw

- 33 Marlborough Dr, Marlborough, Harare, Zimbabwe

Degree Programs

Short Seminar

Short Courses

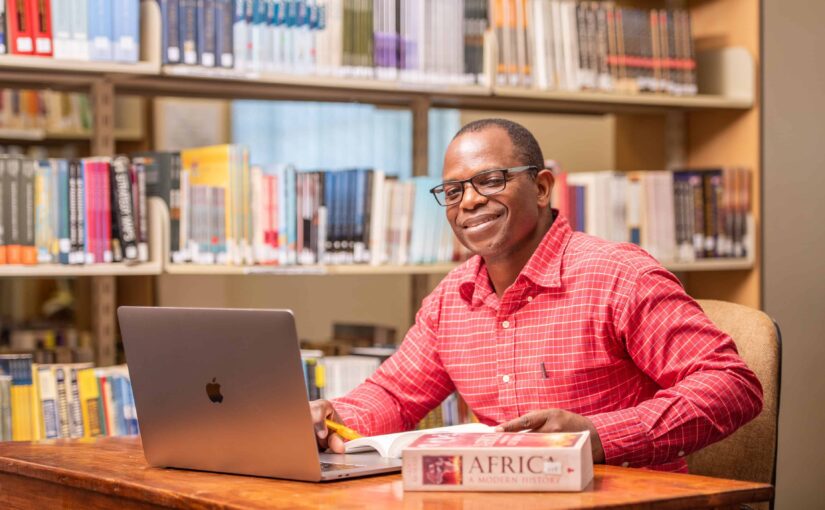

Welcome to ALMA

Africa Leadership and Management Academy (ALMA) is a leadership school that was born out of a crying need for leaders of integrity to spearhead Africa’s transformation from spiritual, social and moral bankruptcy as well as economic oppression. The idea of starting ALMA was the outcome of a meeting held in December 1994, at the Pan African Christian Leadership Assembly (PACLA II) in Kenya, hosted by the Association of Evangelicals in Africa (AEA). Delegates included Evangelical Christian leaders from all over the continent.

Degree & Certificate Programs

Gallery

Welcome to the ALMA Projects Gallery! This collection highlights our training sessions, events, and activities designed to cultivate leadership of integrity. Explore the moments captured during our programs and witness the growth and development of future leaders committed to making a positive impact.

Latest News